In April, I reported that several U.S. insurance companies were lobbying to convince the United States government that they are not important. Naturally, this sounds a bit odd and some explanation is needed.

The World is Watching

After the massive economic crash and bank bailouts, the U.S. and 19 other leading economies (of the G-20 summit) decided some new, stricter regulations are needed so we can avoid another economic disaster. At the G-20 summit, nine insurers were deemed “systemically important” enough that they must be regulated.

The Notorious Nine

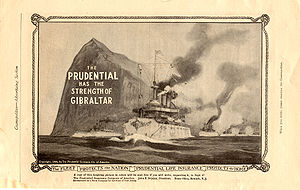

Three of the nine are American – MetLife, AIG, and Prudential Financial.

AIG did not object to their new designation, accepting that they would be regulated more carefully. After all, AIG was one of the giant corporations that was bailed out by the American government. Arguing they should be exempt from regulations to prevent future bail outs would be difficult for them, since it is common knowledge that they were a big part of the problem. However, MetLife and Prudential have objected strongly, and still hope to avoid additional regulation. Their chances of doing so are pretty slim.

The other insuers which will be subject to stricter international regulations are Allianz (Germany), Assicurazioni Generali (Italy), Aviva (U.K.), Axa (France), Prudential Plc (U.K.), and Ping An Insurance Company (China).