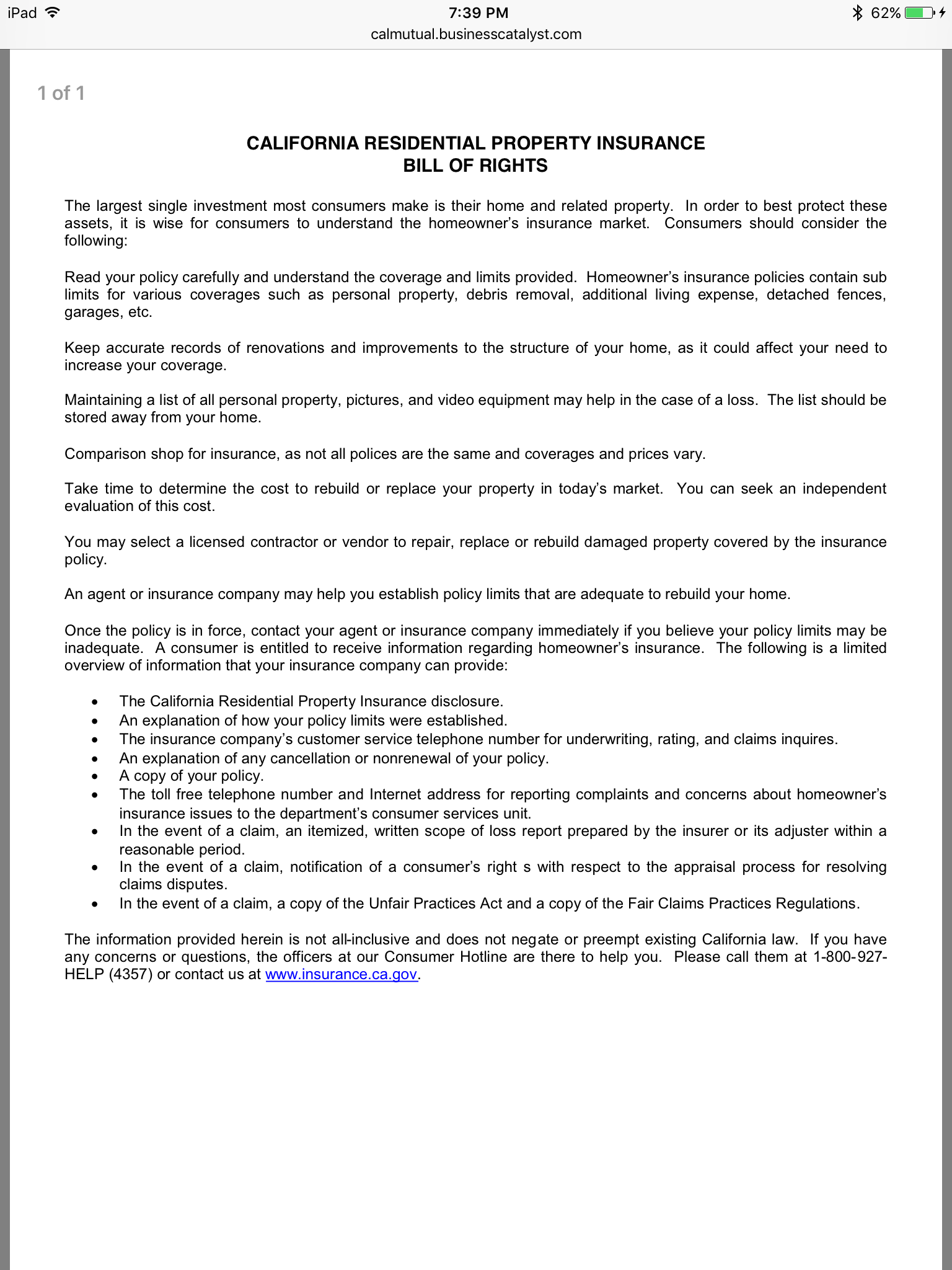

When you receive your homeowners policy, there may be a page called the Residential Property Insurance Bill of Rights.* With a title like “bill of rights” you would expect the document to clearly explain what you can do when you are not treated fairly by your insurance company. Well, not really.

Here are some of the major “Rights” listed under the California Homeowners (i.e. Residential Property) Bill of Rights, with some explanation – I’ll possibly create a Part II to this blog post, so I can cover more of the rights:

The Right to Your Policy

This one surprised me the most. An insurance policy is a contract between you and your insurance company. You definitely should have a copy. How do you know what your responsibilities are if you don’t have the policy? How do you know what your insurance company owes you if you don’t have the policy?

If your insurer provides you with anything – it should be the policy. Basic contract law (and HELLO, common sense) dictates that you need to know what you signed up for.

The real reason this right is listed:

If you request your policy from your insurer, they are typically VERY slow about getting a copy to you. In my experience, some insurers are quite prompt and you’ll have it in 1-2 weeks, but most will take 1-2 months. Then there are others that will take 2-10 months.

In case you haven’t ascertained yet by the many blog posts here on MisInsured, insurance companies are very customer-oriented on the sales end (when you purchase your policy), but after that, you are basically on your own. If you need something, your request is not priority because you are already paying premiums. Brokers and agents are no longer your friends, unless there is additional money in it for them. You need a copy of your policy? They will tell you it is no problem at all. But then you will wait, and wait, and wait some more…

An Explanation of How Your Policy Limits Were Established

Most people don’t particularly care how their policy limits were established, as long as their premiums are low. However, when you find yourself making a claim and suddenly you don’t think you have enough coverage, you will want to know why.

The real reason this right is listed:

I’ve never seen an insurance company formally explain how an insured’s policy limits were established without the insured needing to ask for an explanation more than once. Even when an “explanation” is finally provided, it does not exhaustively explain how the limits were calculated, but will list several assumptions which were made about the property and some calculations. The explanation will leave you with dozens more questions.

*These exist for several different types of insurance. For illustrative purposes, I’m referring to the Residential Property version for the State of California.